The Agentic Era is Here

Built on Agents. Powered by Context. Driven by Result.

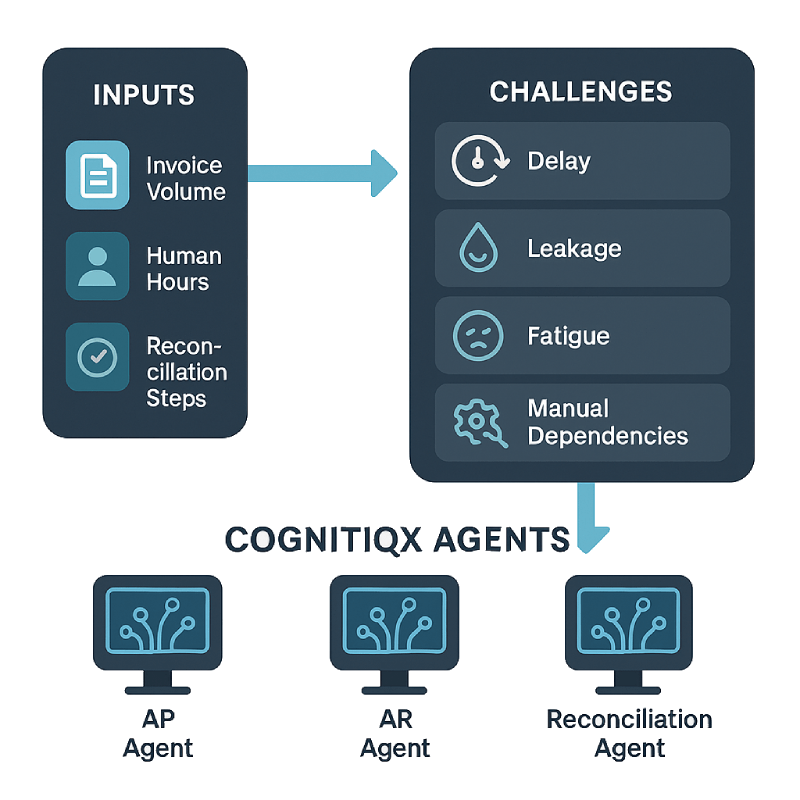

Our architecture deploys intelligent agents that adapt in real time, reason across data sources, and drive outcomes not just tasks. From invoice processing to fraud detection, every decision is contextual, autonomous, and aligned to business goals.

Our memory-backed agents operate across your ERP, inboxes, ledgers, and policy engines, delivering real-time reconciliation, anomaly detection, and compliant decision-making at scale.

Faster Close

Automation

Cost Savings

Audit Coverage

Before

- OCR/NLP-based invoice ingestion

- AI-driven 2-/3-way PO matching

- Duplicate and fraud detection

- Auto-routing and touchless payment execution

Turn Finance Into a Self-Operating System

Most finance tools report data. Cognitiqx acts on it.

We deploy pre-trained agents that reason, reconcile, and execute autonomously across the systems and controls you already use.

How We Stand Apart

When Your Finance Ops Are Smarter Than Your Forecast Model

We want to create superior value for our clients, shareholders and employees. And we want to stand out as a winner in our industry for our expertise, advice and execution.

Built for Finance, Not Just IT

Agentic AI tuned to the nuances of finance—from invoice-to-pay to multi-ledger reconciliation logic.

Live Auditability

Every action traceable. Every exception documented. Every outcome explainable.

ERP-Native, Not ERP-Dependent

CognitiqX sits atop your existing SAP, Oracle, NetSuite stack—integrating seamlessly, not replacing.

Continuous Execution, Zero Fatigue

Agents run 24/7. They don’t escalate—they solve.

Work Process

How it works

Step 1: Create Account

Easily create your Zaplin account with one click and get 100 Million Tokens

Step 2: Type Contex

Easily create your Zaplin account with one click and get 100 Million Tokens

Step 3: Get Images

Easily create your Zaplin account with one click and get 100 Million Tokens

Client Testimonials

The Most Strategic Thing We’ve Done in Finance

CognitiqX agents are not assistants. They’re the future of finance execution.

BFSI Firm

Global ControllerThe first time our close ran autonomously, we realized we were no longer operating. We were orchestrating.

Tech Unicorn

Head of Finance OpsWe didn't just automate—we offloaded core financial execution to agents. CognitiqX made that not only possible but scalable.

Healthcare Enterprise

CFOFrom Ops to Outcomes: Where our Agents Excel

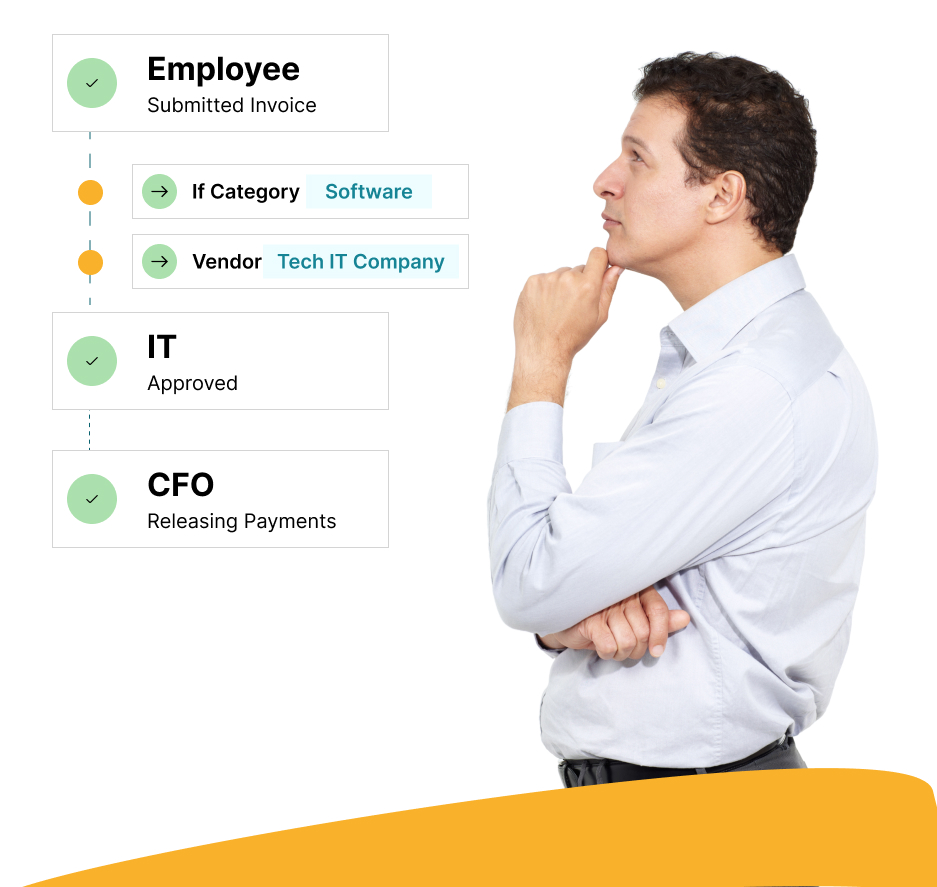

AP Automation

Automates the entire accounts payable process, from invoice capture to payment execution. Cognitiqx AI agents eliminate manual data entry, reduce errors, and accelerate approvals—resolving bottlenecks and enhancing vendor relationships.

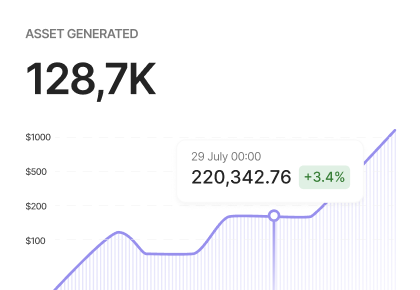

AR Intelligence

Streamlines accounts receivable tasks including invoicing, collections, and cash application. Cognitiqx AI agents proactively manage follow-ups, detect anomalies, and ensure timely collections—solving delays and inefficiencies in cash flow management.

Reconciliation Automation

Simplifies and automates transaction matching across accounts, statements, and ledgers. Cognitiqx AI agents handle complex matching rules, identify discrepancies in real-time, and drastically cut down on manual reconciliation time.

Budgeting & Forecasting

Facilitates accurate financial planning using historical data and predictive analytics. Cognitiqx AI agents adapt to changing variables, identify trends, and offer dynamic forecasts—overcoming rigid, error-prone spreadsheet-based planning.

Tax Compliance & Reporting

Ensures adherence to local and global tax regulations with accurate, timely reporting. Cognitiqx AI agents keep up with regulatory changes, auto-fill tax forms, and flag inconsistencies—minimizing compliance risk and audit exposure.

Payroll Processing

Automates salary calculation, deductions, and disbursements while ensuring legal compliance. Cognitiqx AI agents manage data integration, validate pay components, and detect anomalies—resolving inconsistencies and reducing payroll errors.

Audit & Risk Management

Enables continuous monitoring of processes to identify risks and ensure regulatory compliance. Cognitiqx AI agents perform real-time audit trails, uncover hidden risks, and provide intelligent alerts—streamlining compliance and governance workflows.